what is the total amount to be budgeted for direct labor for the month?

Budgeting

41 Prepare Financial Budgets

Now that y'all take adult an understanding of operating budgets, permit's turn to the other primary component of the chief upkeep: financial budgets. Preparing financial budgets involves examining the expectations for financing the operations of the business and planning for the cash needs of the arrangement. The budget helps estimate the source, amount, and timing of cash collection and greenbacks payments also as determine if and when additional financing is needed or debt can be paid.

Individual Financial Budgets

Preparing a financial budget first requires preparing the capital asset upkeep, the cash budgets, and the budgeted remainder sheet. The capital letter asset budget represents a significant investment in cash, and the corporeality is carried to the cash budget. Therefore, it needs to be prepared before the cash upkeep. If the greenbacks will non be available, the capital asset upkeep can be adapted and, again, carried to the greenbacks budget.

When the budgets are consummate, the beginning and ending remainder from the greenbacks upkeep, changes in financing, and changes in equity are shown on the budgeted balance canvass.

Uppercase Asset Upkeep

The capital nugget upkeep, likewise called the capital expenditure budget, shows the company'south plans to invest in long-term assets. Some assets, such as computers, must be replaced every few years, while other assets, such as manufacturing equipment, are purchased very infrequently. Some avails can be purchased with cash, whereas others may require a loan. Budgeting for these types of expenditures requires long-range planning because the purchases touch on cash flows in current and future periods and bear on the income statement due to depreciation and involvement expenses.

Cash Upkeep

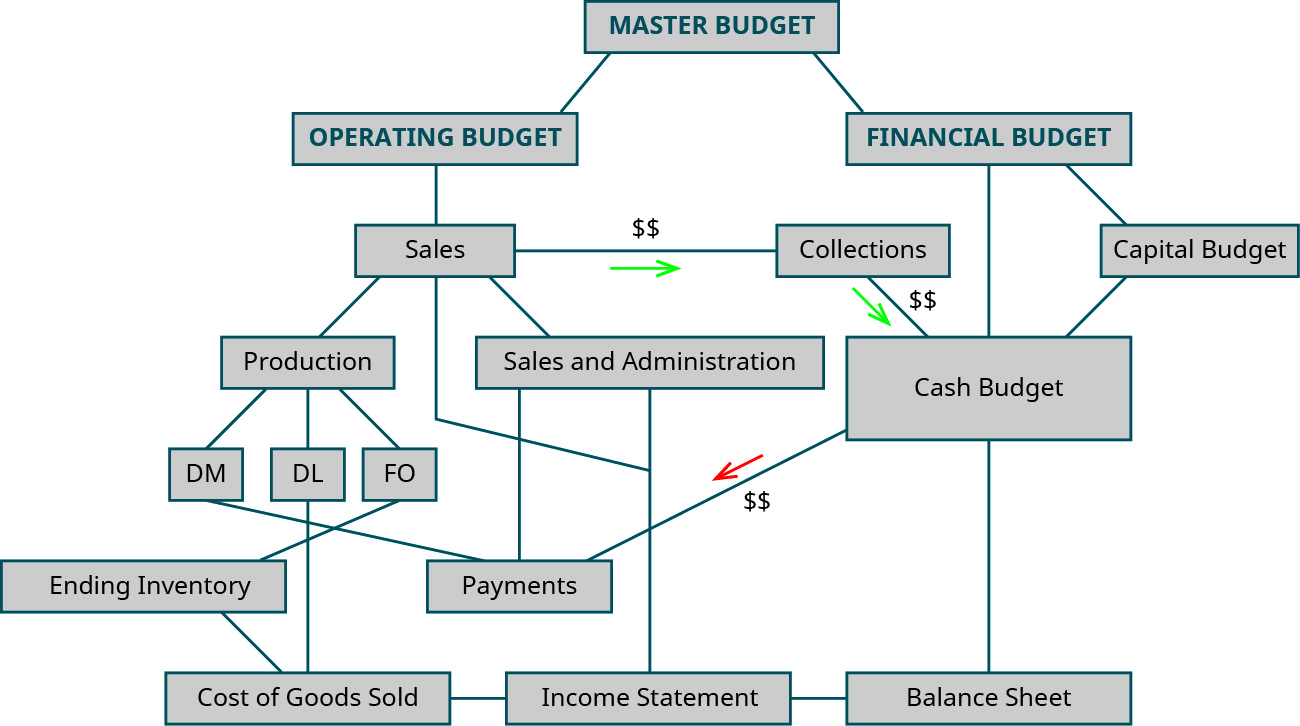

The greenbacks upkeep is the combined budget of all inflows and outflows of greenbacks. Information technology should exist divided into the shortest time catamenia possible, then direction can be rapidly fabricated aware of potential problems resulting from fluctuations in cash menstruum. 1 goal of this upkeep is to anticipate the timing of cash inflows and outflows, which allows a visitor to try to avoid a decrease in the greenbacks residual due to paying out more greenbacks than information technology receives. In guild to provide timely feedback and alarm management to curt-term cash needs, the greenbacks flow upkeep is commonly geared toward monthly or quarterly figures. (Figure) shows how the other budgets tie into the greenbacks budget.

Human relationship betwixt Budgets. (attribution: Copyright Rice Academy, OpenStax, nether CC Past-NC-SA 4.0 license)

Cash is so important to the operations of a company that, often, companies will arrange to accept an emergency greenbacks source, such as a line of credit, to avoid defaulting on current payables due and besides to protect against other unanticipated expenses, such every bit major repair costs on equipment. This line of credit would be similar in office to the overdraft protection offered on many checking accounts.

Because the cash budget accounts for every arrival and outflow of cash, it is broken downward into smaller components. The cash collections schedule includes all of the cash arrival expected to exist received from customer sales, whether those customers pay at the same rate or even if they pay at all. The greenbacks collections schedule includes all the cash expected to exist received and does not include the amount of the receivables estimated as uncollectible. The greenbacks payments schedule plans the outflow or payments of all accounts payable, showing when cash will be used to pay for direct material purchases. Both the cash collections schedule and the cash payments schedule are included along with other cash transactions in a cash upkeep. The cash upkeep, so, combines the cash collection schedule, the cash payment schedule, and all other budgets that program for the arrival or outflow of cash. When everything is combined into 1 budget, that budget shows if financing arrangements are needed to maintain balances or if excess cash is available to pay for additional liabilities or assets.

The operating budgets all begin with the sales budget. The cash collections schedule does as well. Since purchases are made at varying times during the menstruation and cash is received from customers at varying rates, data are needed to gauge how much will exist collected in the month of sale, the month afterwards the sale, two months after the sale, and then forth. Bad debts as well demand to be estimated, since that is cash that will not be nerveless.

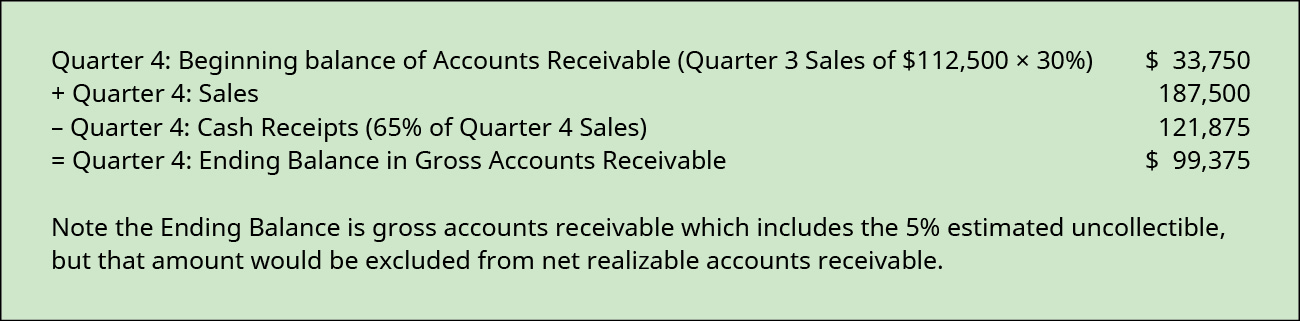

To illustrate, permit's render to Big Bad Bikes. They believe cash collections for the trainer sales volition be similar to the collections from their bicycle sales, so they will use that pattern to budget cash collections for the trainers. In the quarter of sales, 65% of that quarter's sales volition be collected. In the quarter afterwards the sale, 30% will be collected. This leaves 5% of the sales considered uncollectible. (Figure) illustrates when each quarter'southward sales will exist collected. An estimate of the net realizable rest of Accounts Receivable can exist reconciled by using information from the greenbacks collections schedule:

Illustration of a Cash Collections Schedule. (attribution: Copyright Rice Academy, OpenStax, under CC BY-NC-SA four.0 license)

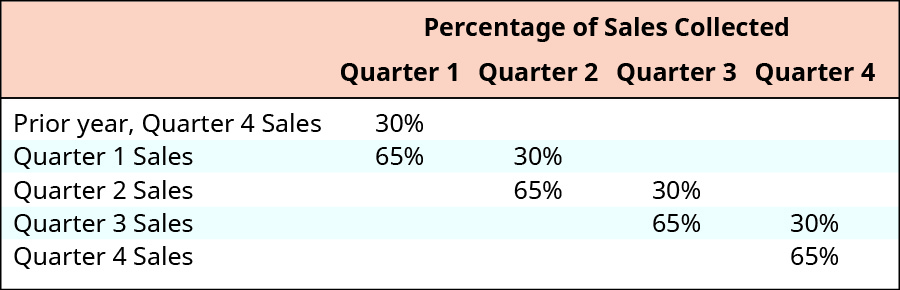

For example, in quarter one of twelvemonth 2, 65% of the quarter i sales will exist collected in cash, also as 30% of the sales from quarter 4 of the prior year. There were no sales in quarter four of the prior year so 30% of naught sales shows the collections are $0. Using information from Large Bad Bikes sales budget, the cash collections from the sales are shown in (Figure).

Cash Collections Schedule for Big Bad Bikes. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA four.0 license)

When the greenbacks collections schedule is made for sales, management must account for other potential cash collections such equally cash received from the sale of equipment or the issuance of stock. These are listed individually in the greenbacks inflows portion of the cash budget.

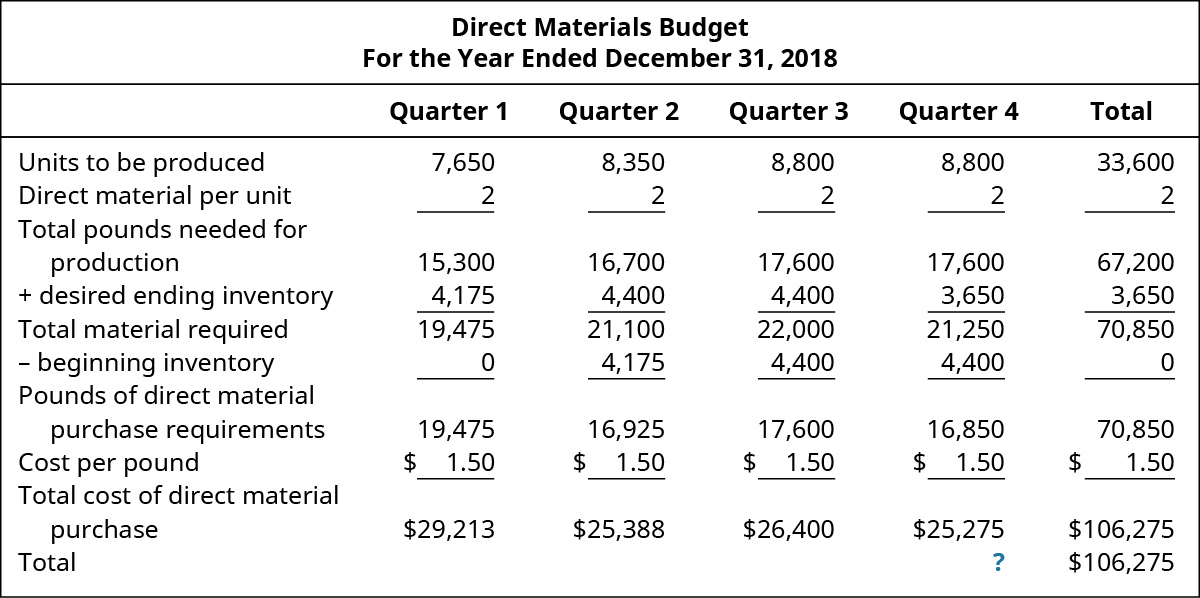

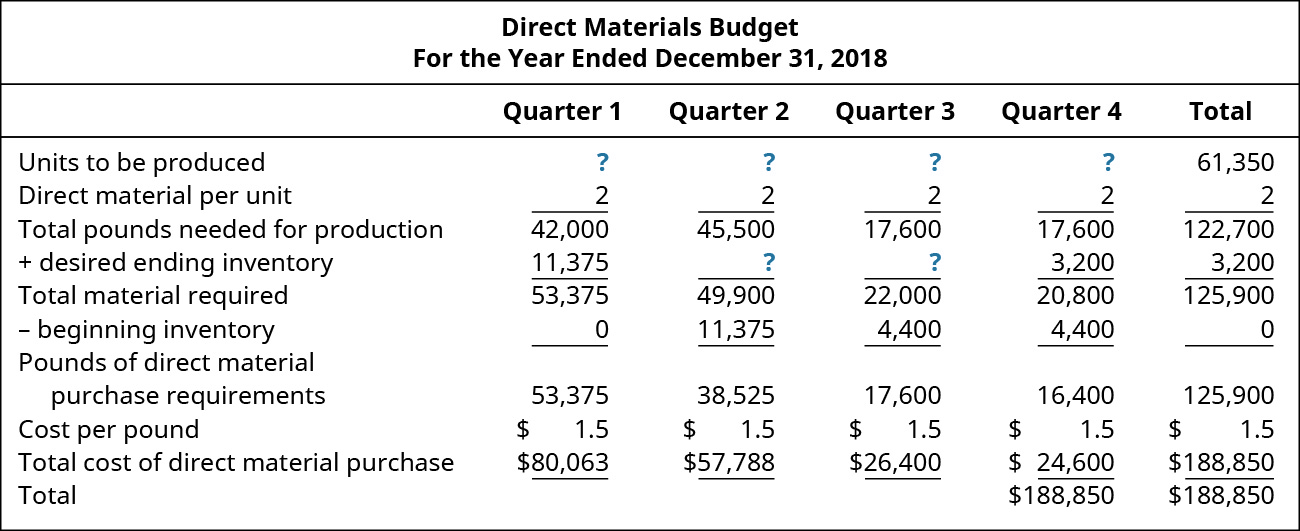

The cash payments schedule, on the other hand, shows when cash will exist used to pay for Accounts Payable. 1 such instance are direct material purchases, which originates from the directly materials budget. When the production budget is determined from the sales, management prepares the direct materials budget to determine when and how much material needs to be ordered. Orders for materials accept identify throughout the quarter, and payments for the purchases are fabricated at dissimilar intervals from the orders. A schedule of cash payments is similar to the cash collections schedule, except that it accounts for the company's purchases instead of the company'due south sales. The information from the cash payments schedule feeds into the cash budget.

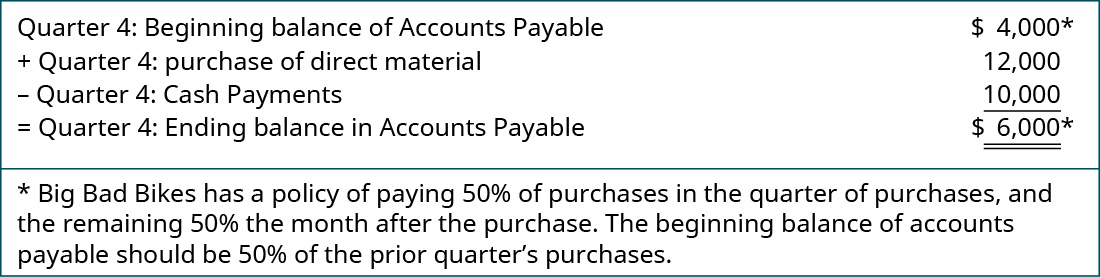

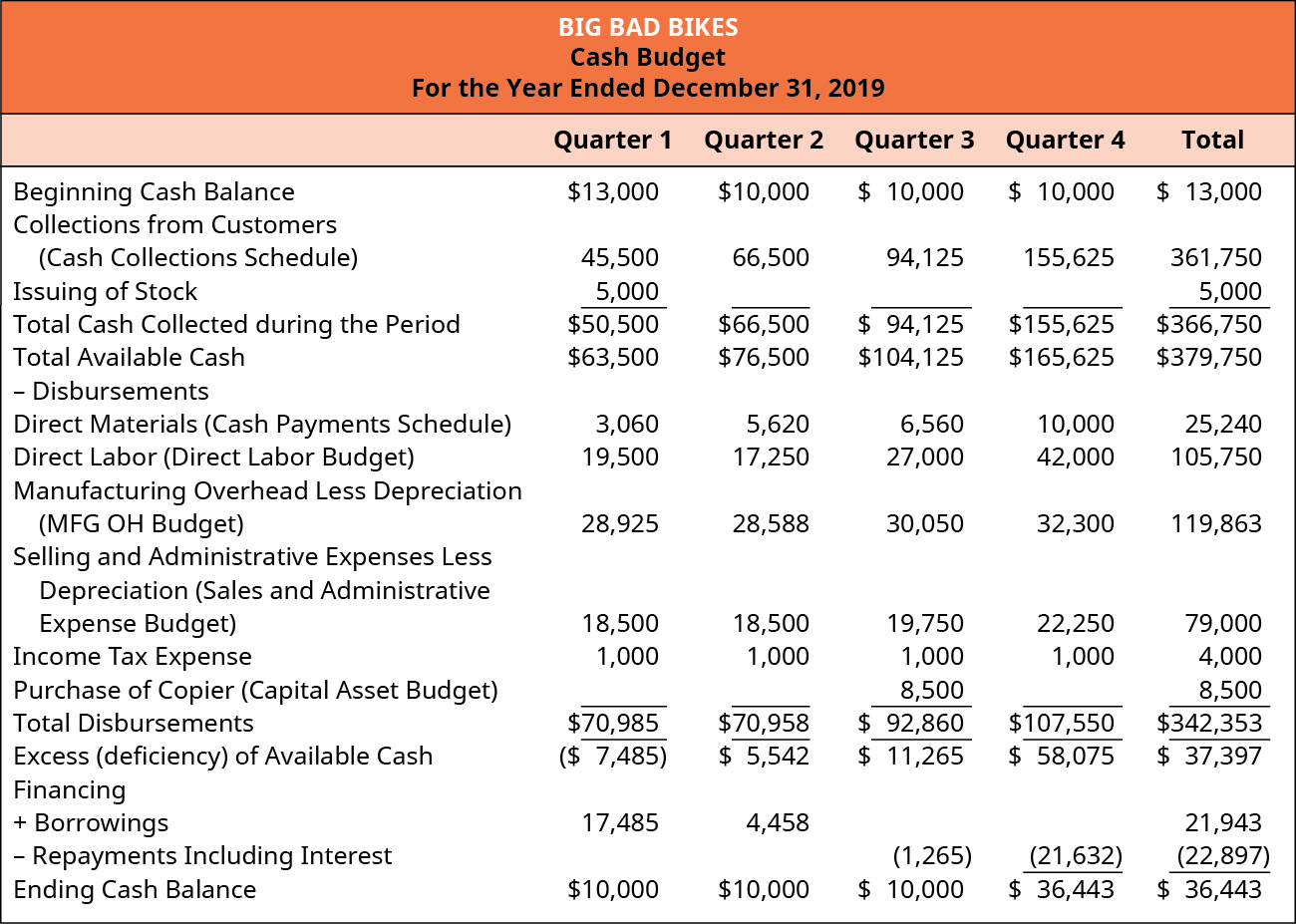

Large Bad Bikes typically pays half of its purchases in the quarter of buy. The remaining half is paid in the post-obit quarter, so payments in the get-go quarter include payments for purchases fabricated during the commencement quarter as well equally half of the purchases for the preceding quarter. (Figure) shows when each quarter's purchases will be paid. Additionally, the balance of purchases in Accounts Payable can be reconciled past using information from the greenbacks payment schedule as follows:

Cash Payment Schedule. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

The first quarter of the year plans cash payments from the prior quarter as well as the current quarter. Again, since the trainers are a new production, in this example, there are no purchases in the preceding quarter, and the payments are $0. (Figure).

Cash Payments Schedule for Large Bad Bikes. (attribution: Copyright Rice University, OpenStax, nether CC By-NC-SA 4.0 license)

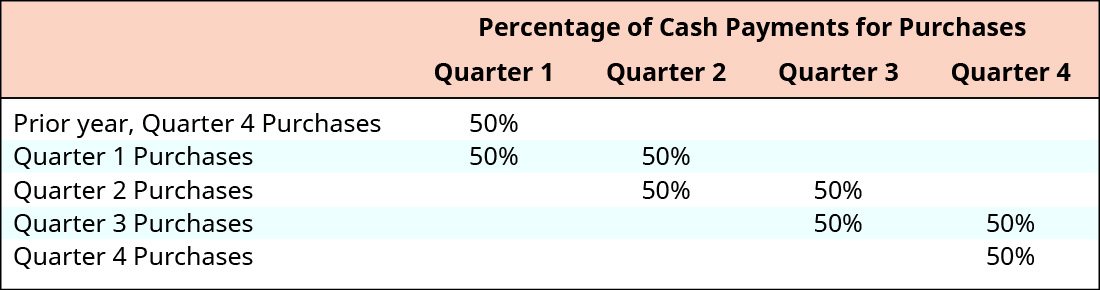

While the cash payments schedule is fabricated for purchases of material on account, in that location are other outflows of cash for the company, and management must estimate all other cash payments for the year. Typically, this includes the manufacturing overhead budget, the sales and administrative budget, the uppercase nugget budget, and any other potential payments of greenbacks. Since depreciation is an expense non requiring cash, the cash budget includes the amount from the budgets less depreciation. Cash payments are listed on the cash budget following greenbacks receipts. (Figure) shows the major components of the cash budget.

Full general Overview of Cash Upkeep Components. A greenbacks upkeep will comprise all the approaching cash inflows and out flows from the sub-budgets as well as any cash items that might not announced on one of the sub-budgets. (attribution: Copyright Rice Academy, OpenStax, under CC BY-NC-SA iv.0 license)

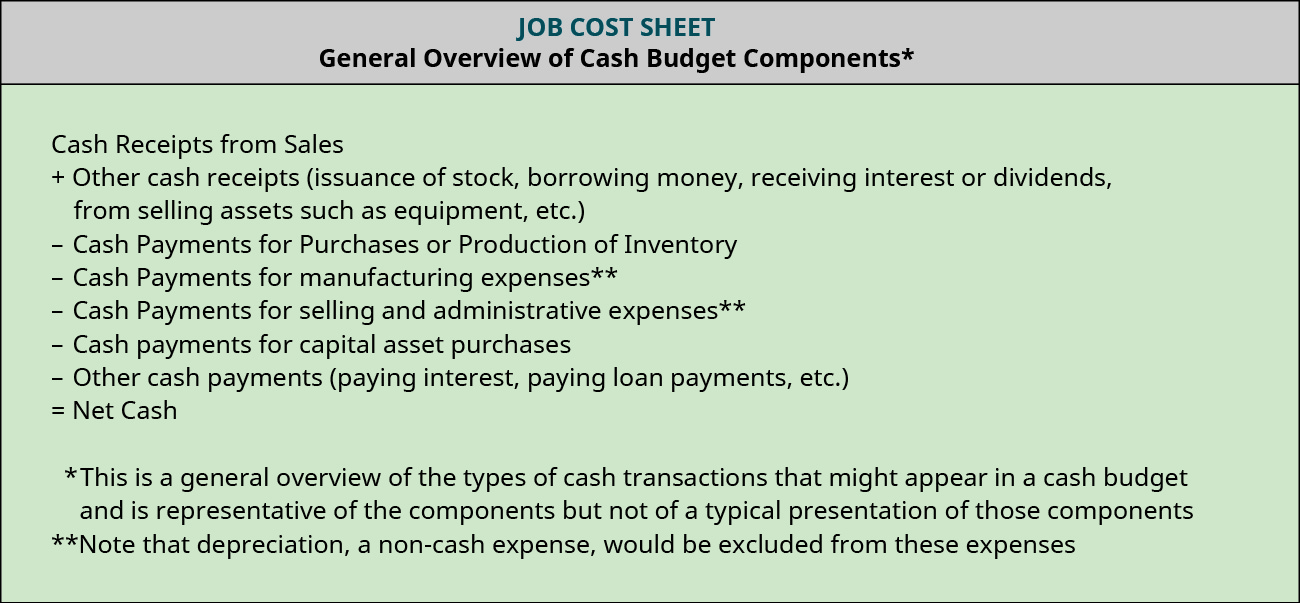

The greenbacks budget totals the greenbacks receipts and adds it to the beginning cash balance to determine the available cash. From the available cash, the cash payments are subtracted to compute the net greenbacks excess or deficiency of cash for the quarter. This amount is the potential ending cash residual. Organizations typically crave a minimum greenbacks remainder. If the potential ending cash residual does non meet the minimum amount, management must plan to acquire financing to reach that amount. If the potential ending cash residue exceeds the minimum greenbacks remainder, the excess amount may be used to pay whatever financing loans and involvement.

Big Bad Bikes has a minimum cash balance requirement of $x,000 and has a line of credit available for an involvement rate of xix%. They also plan to outcome additional majuscule stock for $v,000 in the first quarter, to pay taxes of $1,000 during each quarter, and to buy a copier for $8,500 cash in the third quarter. The beginning cash rest for Big Bad Bikes is $thirteen,000, which can exist used to create the greenbacks budget shown in (Figure).

Cash Budget for Big Bad Bikes. (attribution: Copyright Rice University, OpenStax, nether CC Past-NC-SA 4.0 license)

Budgeted Balance Canvas

The greenbacks budget shows how cash changes from the beginning of the twelvemonth to the finish of the twelvemonth, and the ending cash balance is the amount shown on the budgeted balance canvass. The budgeted balance sheet is the estimated assets, liabilities, and equities that the company would have at the end of the year if their functioning were to meet its expectations. (Figure) shows a list of the virtually mutual changes to the balance sheet and where the information is derived.

| Mutual Changes in the Budgeted Balance Canvass | |

|---|---|

| Information Source | Balance Sheet Change |

| Cash balance | ending greenbacks balance from the cash budget |

| Accounts Receivable balance | uncollected receivables from the cash collections schedule |

| Inventory | ending balance in inventory equally shown from calculations to create the income argument |

| Mechanism & Equipment | ending remainder in the capital letter nugget upkeep |

| Accounts Payable | unpaid purchases from the greenbacks payments schedule |

Other rest sheet changes throughout the year are reflected in the income statement and argument of cash flows. For example, the beginning cash balance of Accounts Receivable plus the sales, less the cash collected results in the ending residual of Accounts Receivable. A similar formula is used to compute the ending rest in Accounts Payable. Other budgets and data such as the capital asset budget, depreciation, and financing loans are used too.

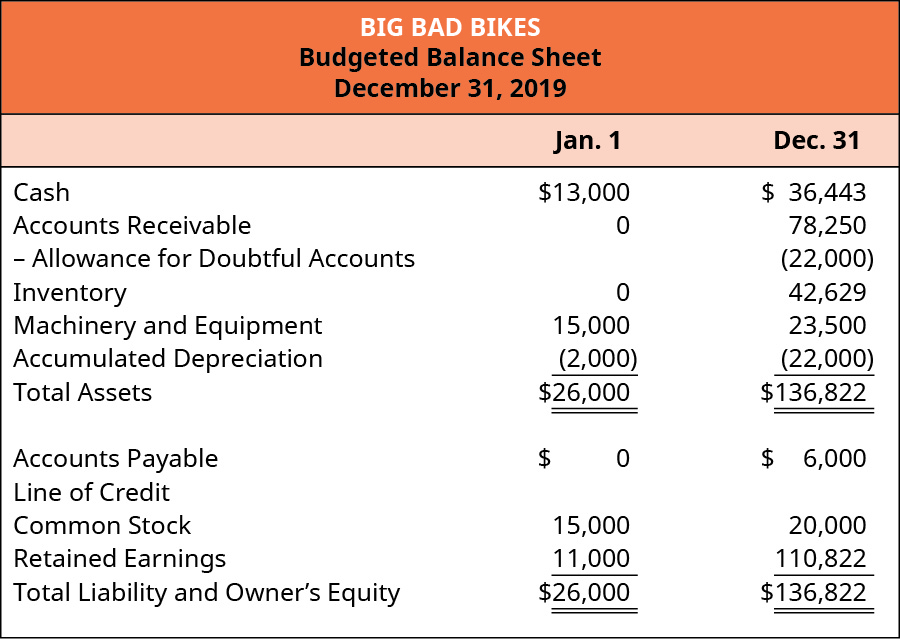

To explain how to use a budgeted remainder sheet, let'south return to Big Bad Bikes. For simplicity, assume that they did non have accounts receivable or payable at the beginning of the year. They also incurred and paid back their financing during the year, so there is no ending debt. However, the cash budget shows greenbacks inflows and outflows not related to sales or the purchase of materials. The company'due south capital assets increased by $eight,500 from the copier purchase, and their common stock increased by $5,000 from the additional result as shown in (Figure).

Budgeted Residual Sheet for Big Bad Bikes. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA 4.0 license)

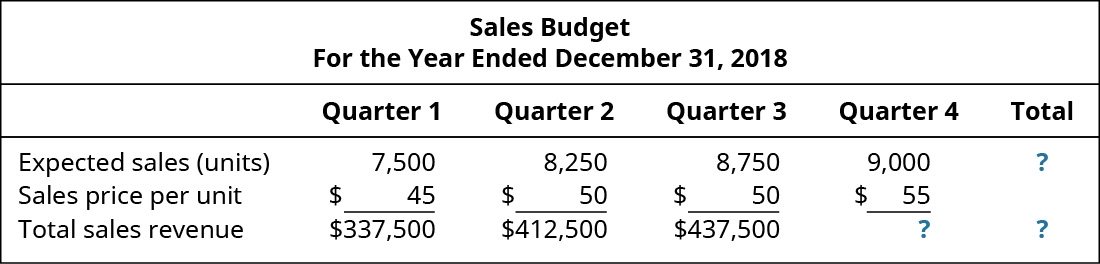

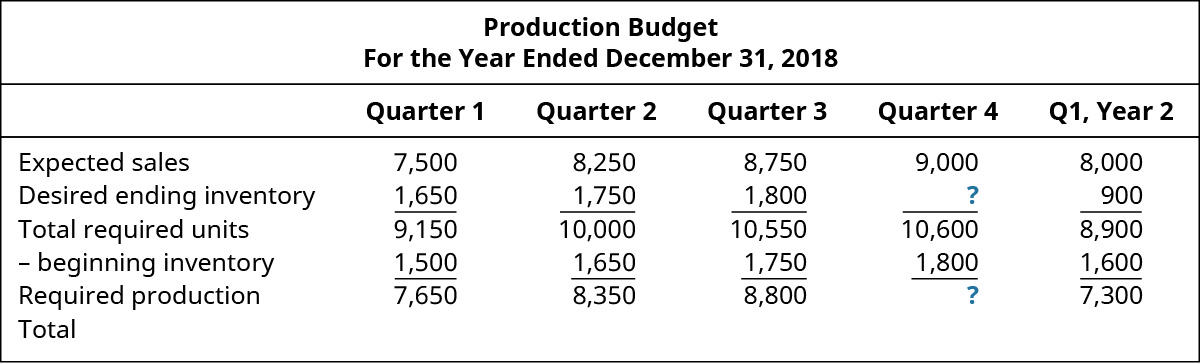

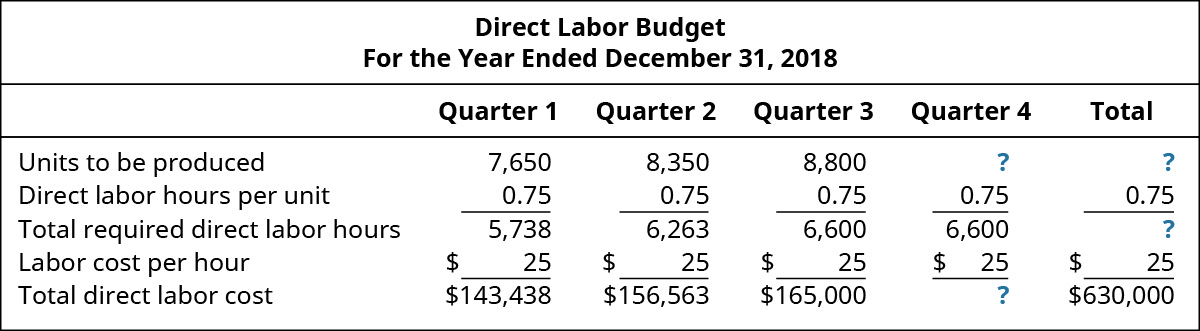

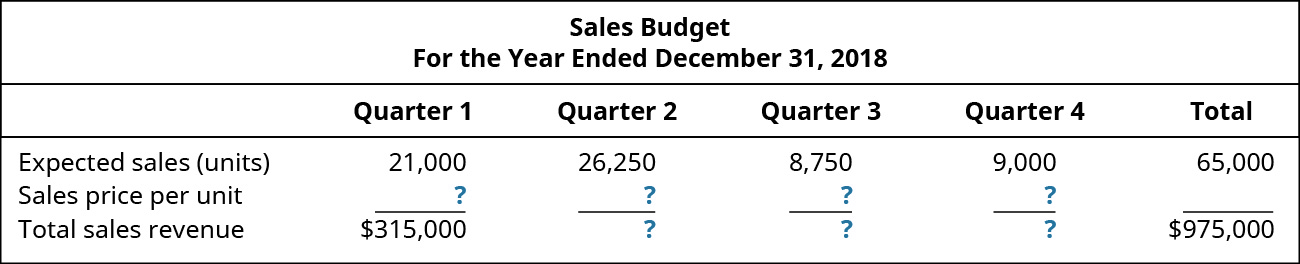

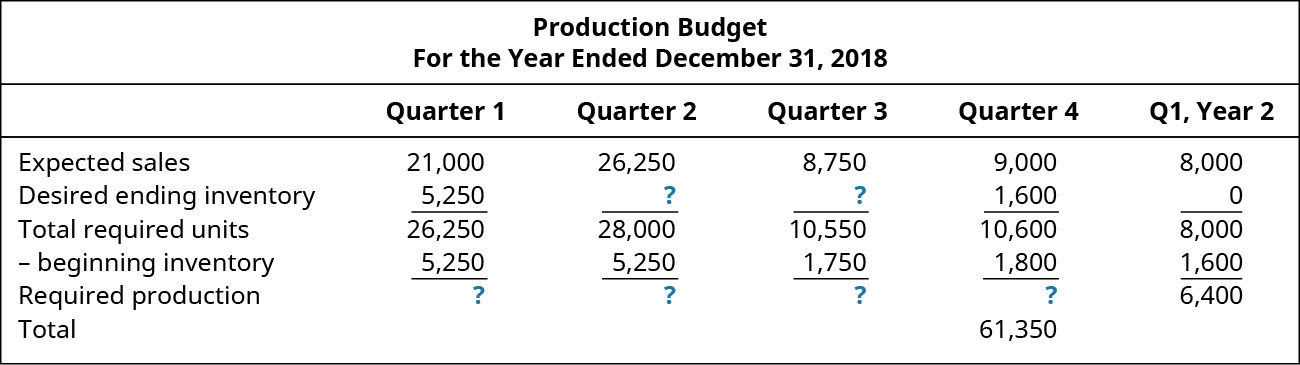

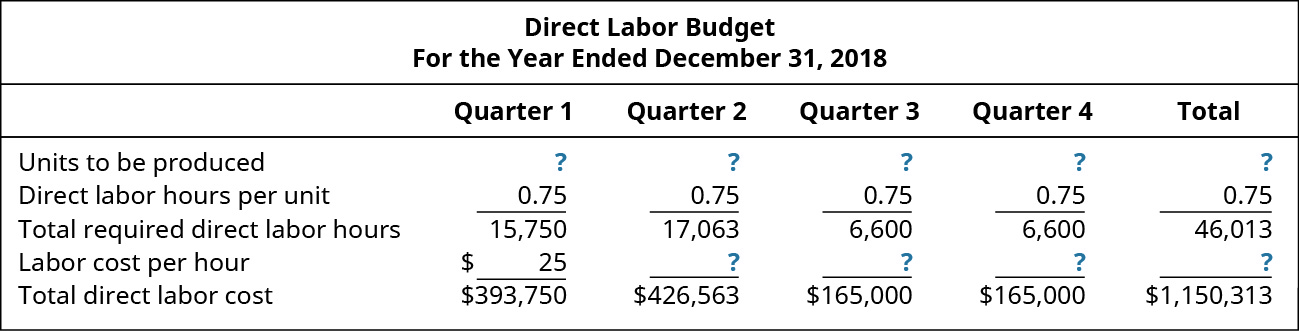

Though in that location seem to be many budgets, they all fit together similar a puzzle to create an overall flick of how a company expects the upcoming business year to look. (Figure) detailed the components of the master budget, and can be used to summarize the budget process. All budgets begin with the sales budget. This upkeep estimates the number of units that need to be manufactured and precedes the product budget. The production upkeep (refer to (Effigy)) provides the necessary information for the budgets needed to plan how many units will be produced. Knowing how many units need to be produced from the production budget, the direct materials budget, direct labor budget, and the manufacturing overhead upkeep are all prepared. The sales and authoritative upkeep is a nonmanufacturing budget that relies on the sales estimates to pay commissions and other variable expenses. The sales and expenses estimated in all of these budgets are used to develop a budgeted income argument.

The estimated sales information is used to prepare the cash collections schedule, and the direct materials budget is used to fix the cash payment schedule. The cash receipts and cash payments upkeep are combined with the direct labor budget, the manufacturing overhead upkeep, the sales and administrative budget, and the capital assets upkeep to develop the greenbacks budget. Finally, all the information is used to menses to the budgeted balance canvas.

Creating a Master Budget

Molly Malone is starting her ain company in which she will produce and sell Molly's Macaroons. Molly is trying to learn virtually the budget process as she puts her business plan together. Assistance Molly past explaining the optimal order for preparing the following budgets and schedules and why this is the optimal social club.

- budgeted balance canvas

- budgeted income statement

- capital asset budget

- cash upkeep

- cash collections schedule

- cash payments schedule

- direct materials budget

- directly labor budget

- master budget

- manufacturing overhead

- production budget

- sales upkeep

- selling and authoritative budget

Solution

A main budget ever begins with the sales budget must be prepared first as this determines the number of units that will need to exist produced. The next step would be to create the production budget, which helps determine the number of units that will need to exist produced each period to meet sales goals. Once Molly knows how many units she volition need to produce, she will need to budget the costs associated with those units, which volition crave her to create the straight materials budget, the straight labor budget and the manufacturing overhead budget. Just Molly will have costs other than manufacturing costs and then she will need to create a selling and authoritative expenses budget. Molly will need to determine what are her capital letter asset needs and budget for those. Now that Molly has all her revenues approaching and her costs budgeted, she can decide her budgeted cash inflows and outflows past putting together the greenbacks schedules that lead to the greenbacks upkeep. Molly will then need to create a greenbacks collections schedule and a cash payments schedule and that information, along with the cash inflow and outflow information from her other budgets, will allow her to create her cash budget. Once Molly has completed her greenbacks budget she volition exist able to put together her approaching income argument and approaching rest canvas.

Key Concepts and Summary

- The financial budgets include the capital asset budget and the cash budget. The cash collections schedule and cash payments schedule are computed and combined with the other budgets to develop the cash budget.

- Information from the other budgets and the budgeted income statement are used to develop the budgeted residue sheet.

(Effigy)The cash budget is office of which category of budgets?

- sales budget

- greenbacks payments budget

- finance budget

- operating upkeep

(Figure)Which is not a department of the cash budget?

- cash receipts

- cash disbursements

- assart for uncollectible accounts

- financing needs

(Figure)Which budget is the starting point in preparing financial budgets?

- the budgeted income statement

- the budgeted balance sail

- the uppercase expense budget

- the cash receipts budget

(Figure)Which of the following includes merely financial budgets?

- capital asset budget, budgeted income argument, sales budget

- production upkeep, uppercase asset budget, budgeted residual sheet

- cash budget, budgeted residue sheet, majuscule nugget budget

- approaching income statement, direct textile purchases upkeep, cash upkeep

(Figure)What is the procedure for developing a budgeted balance sail?

The approaching income argument includes the estimated revenue and expenses for the company. Using historical information on greenbacks collections helps plan when the cash will be received and is used to develop the cash collections schedule. The company applies its payment policies on its purchases and other items requiring cash expenditures. This creates the greenbacks payments schedule. Data from the cash collections schedule, cash payments schedule, and the capital expense upkeep are combined to develop the cash budget. The information from the cash budget and the ending balance canvass from the preceding yr are used to develop the budgeted balance sheet.

(Effigy)Which of the fiscal budgets is the most important? Why?

(Effigy)Cash collections for Wax On Candles constitute that 60% of sales were collected in the month of the auction, 30% was nerveless the month after the sale, and 10% was collected the second month later the auction. Given the sales shown, how much greenbacks will be collected in Jan and February?

(Effigy)Nonna'south Re-Appliance Store collects 55% of its accounts receivable in the month of sale and 40% in the month after the sale. Given the following sales, how much greenbacks will be nerveless in February?

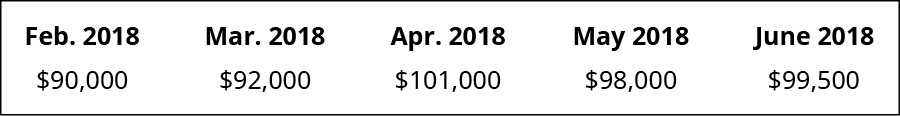

(Figure)Dream Big Pillow Co. pays 65% of its purchases in the month of purchase, 30% the month afterwards the purchase, and 5% in the second month following the purchase. It made the following purchases at the end of 2017 and the starting time of 2018:

(Figure)Desiccate purchases direct materials each month. Its payment history shows that seventy% is paid in the month of buy with the remaining residue paid the month later purchase. Set a cash payment schedule for March if in January through March, it purchased $35,000, $37,000, and $39,000, respectively.

(Effigy)What is the corporeality of approaching cash payments if purchases are budgeted for $420,000 and the offset and ending balances of accounts payable are $95,000 and $92,000, respectively?

(Figure)Halifax Shoes has 30% of its sales in cash and the residuum on credit. Of the credit sales, 65% is nerveless in the month of auction, 25% is collected the calendar month after the auction, and 5% is nerveless the second month after the sale. How much cash will be collected in August if sales are estimated equally $75,000 in June, $65,000 in July, and $90,000 in August?

(Figure)Cash collections for Renew Lights found that 65% of sales were collected in the month of auction, 25% was collected the month after the auction, and 10% was collected the second calendar month after the sale. Given the sales shown, how much greenbacks will be nerveless in March and April?

(Effigy)My Aunt's Closet Store collects 60% of its accounts receivable in the calendar month of sale and 35% in the calendar month after the sale. Given the following sales, how much cash volition exist collected in March?

(Effigy)Ready Co. pays 65% of its purchases in the month of buy, 30% in the month afterwards the purchase, and 5% in the 2nd calendar month following the purchase. What are the cash payments if it made the following purchases in 2018?

(Figure)Drainee purchases straight materials each month. Its payment history shows that 65% is paid in the calendar month of purchase with the remaining balance paid the month after buy. Ready a cash payment schedule for Jan using this data: in December through February, information technology purchased $22,000, $25,000, and $23,000 respectively.

(Figure)What is the amount of budgeted greenbacks payments if purchases are budgeted for $190,500 and the starting time and catastrophe balances of accounts payable are $21,000 and $25,000, respectively?

(Effigy)Earthie's Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of auction, 15% is collected the month subsequently the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?

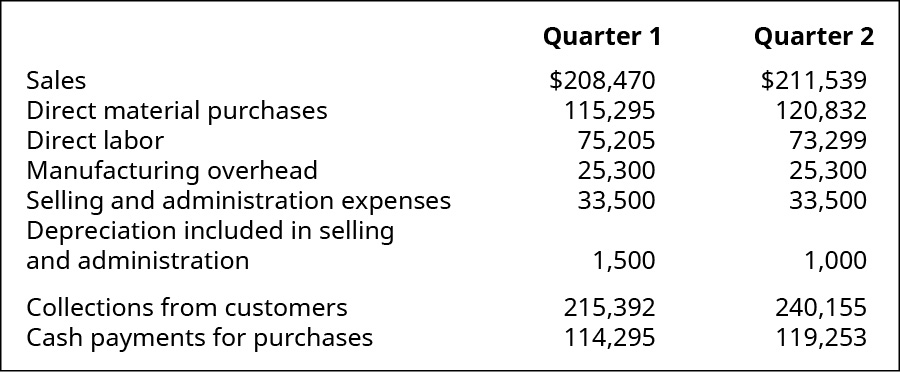

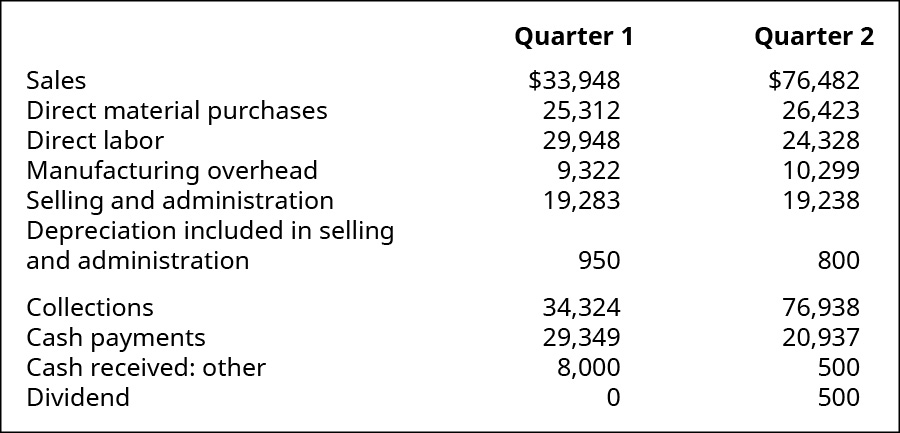

(Effigy)Relevant data from the Affiche Company'south operating budgets are:

Additional information: Capital assets were sold in January for $x,000 and $iv,500 in May. Dividends of $iv,500 were paid in February. The start cash balance was $60,359 and a required minimum cash rest is $59,000. Use this data to prepare a cash budget for the first two quarters of the year

(Figure)Fill in the missing data from the following schedules:

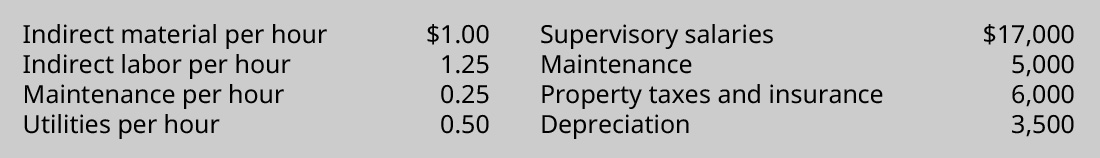

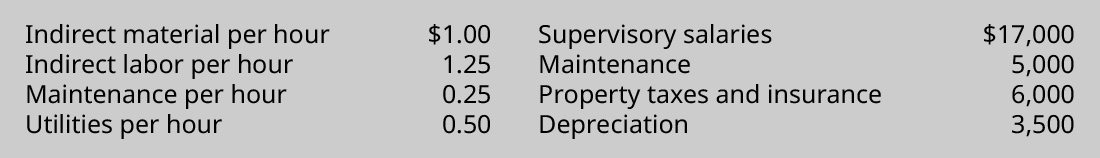

(Figure)Direct labor hours are estimated as 2,000 in Quarter 1; 2,100 in Quarter 2; 1,900 in Quarter iii; and 2,300 in Quarter 4. Prepare a manufacturing overhead upkeep using the information provided.

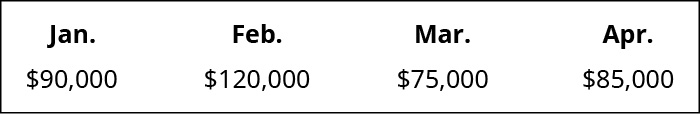

(Figure)Fitbands' estimated sales are:

What are the balances in accounts receivable for January, Feb, and March if 65% of sales is nerveless in the month of sale, 25% is collected the month after the sale, and x% is 2nd calendar month after the sale?

(Figure)Sports Socks has a policy of always paying inside the disbelieve period and each of its suppliers provides a disbelieve of ii% if paid inside 10 days of purchase. Because of the purchase policy, 85% of its payments are made in the calendar month of purchase and 15% are fabricated the following calendar month. The directly materials budget provides for purchases of $129,582 in November, $294,872 in December, $239,582 in January, and $234,837 in February. What is the residuum in accounts payable for January 31, and Feb 28?

(Effigy)Relevant information from the operating upkeep of The Framers are:

Other data:

- Capital avails were sold in quarter 1 and $8,000 was collected in quarter one and $500 nerveless in quarter 2.

- Dividends of $500 will be paid in May

- The beginning cash rest was $50,000 and a required minimum cash rest is $ten,000.

- Prepare a greenbacks budget for the first two quarters of the twelvemonth.

(Effigy)Fill up in the missing information from the following schedules:

(Figure)Mesa Aquatics, Inc. estimated direct labor hours as 1,900 in quarter 1, two,000 in quarter 2, 2,200 in quarter 3, and i,800 in quarter four. a sales and administration budget using the information provided.

(Figure)Amusement tickets estimated sales are:

What are the balances in accounts receivable for April, May, and June if 60% of sales are collected in the month of sale, 30% are nerveless the month after the auction, and 10% are collected the 2d month after the sale?

(Figure)All Temps has a policy of always paying within the discount period, and each of its suppliers provides a discount of ii% if paid within 10 days of purchase. Because of the purchase policy, 80% of its payments are fabricated in the month of purchase and twenty% are made the following calendar month. The direct materials budget provides for purchases of $23,812 in February, $23,127 in March, $21,836 in April, and $28,173 in May. What is the balance in accounts payable for April 30, and May 31?

Glossary

- budgeted rest sheet

- estimated avails, liabilities, and equities that the company would have at the end of the year if their performance were to meet its expectations

- capital asset budget

- upkeep showing the arrangement's plans to invest in long-term assets

- greenbacks budget

- combined budget of all cash inflows and outflows of the organisation

- greenbacks collections schedule

- schedule showing when cash will exist received from customers

- cash payments schedule

- schedule showing when cash will be used to pay for direct fabric purchases

greenbergwrive1959.blogspot.com

Source: https://opentextbc.ca/principlesofaccountingv2openstax/chapter/prepare-financial-budgets/

0 Response to "what is the total amount to be budgeted for direct labor for the month?"

Postar um comentário